If you’ve decided to take on a prop firm futures challenge then it’s a great decision. Whether you’re gunning for a funded account or just want to prove to yourself you’ve got what it takes, the first hurdle is getting your trading platform set up just right.

Getting into a new trading platform can actually be a difficult task. Buttons, charts, toolbars—it’s a lot. And when you’re up against a ticking clock and strict rules then the last thing you want is to be fumbling around trying to figure out how to place a trade or adjust a stop. Let’s talk about everything you need to get set up for a Futures challenge with a prop firm.

Know Your Platform

Most prop firms will require or recommend a best futures trading platform for their challenges. A few of the most common names you’ll hear are:

- Tradovate – Sleek, browser-based, and built for speed.

- NinjaTrader – Powerful, super customizable, and popular with futures traders.

- Rithmic (via third-party platforms) – Known for its fast data feed and low latency.

- TradingView (connected to a futures broker) – Not as common but some firms allow it.

Before You Download Anything

Double-check the challenge rules. Each firm’s challenge might have different platform options, permitted instruments, and allowed data feeds. Don’t assume anything and read the fine print. If you’re not sure then hop on live chat or shoot them a quick email. It’s way better to ask up front than to get disqualified for something like using the wrong data provider.

Step 1: Install and Set Up the Platform

Let’s go with NinjaTrader for this walkthrough, since it’s one of the most widely used platforms for futures challenges. The process is pretty similar for others but I’ll point out some differences where it makes sense.

Download NinjaTrader

Head to the NinjaTrader website and download the latest version. If the prop firm gave you a special version or link, use that one instead.

Create a Free Account

You’ll need to register for a free demo license unless your prop firm gives you credentials. Fill out the form with your email, name, and location.

Once that’s done, you’ll get login credentials sent to your inbox—these will let you access real-time market data through a simulation account.

Connect to the Right Data Feed

Most futures prop firms use Rithmic or CQG for data feeds. Here’s how to connect to Rithmic:

- Open NinjaTrader.

- Go to Connections > Configure.

- Under Available, select Rithmic for NinjaTrader Brokerage and add it to your configured list.

- Plug in the username and password the prop firm gave you.

- Select the correct server, usually Rithmic Paper Trading or whatever the firm specifies.

- Save and connect.

If you see green lights and price data streaming in, you’re good to go.

Step 2: Setting Up Your Workspace

This is where things start to feel real.

Open a Chart

- Right-click the main control center and hit New > Chart.

- Pick your instrument like ES 06-25 for the E-mini S&P 500 futures.

- Choose your time frame—most traders in challenges stick to 1-minute, 5-minute, or tick charts.

- Hit OK.

You’ve got a live chart.

Add Indicators

You don’t need a ton of bells and whistles. A few basics will do:

- Volume

- Moving averages (e.g., 20 EMA and 50 SMA)

- VWAP (great for intraday futures)

- MACD or RSI if you like to add a momentum tool

To add indicators:

- Right-click on the chart > Indicators

- Select what you want and tweak the settings to your style

- Save your template so you can reload it anytime

DOM (Depth of Market)

The DOM is where most futures traders place their orders. It lets you see market depth and place trades with one click.

- Go to New > SuperDOM

- Link it to your instrument (make sure it matches your chart)

- Set it up to show working orders, positions, and PnL

Pro tip: Practice using the DOM in SIM mode before you go live in the challenge. It’s easy to fat-finger a limit order and watch your account take a hit.

Step 3: Customize Your Layout for Speed and Clarity

The challenge clock is ticking. You don’t want to waste time digging through menus or dragging windows around mid-trade.

Link Windows

Use the little color boxes to link your chart, DOM, and market analyzer. That way, when you change a symbol in one window, everything updates together. Super handy.

Create a Watchlist

The Market Analyzer in NinjaTrader lets you keep an eye on multiple futures contracts at once.

- Add instruments like ES, NQ, YM, RTY, or CL

- Include columns for net change, volume, bid/ask spread, and any indicator you want to track

You’ll thank yourself when the market’s moving fast and you need to spot an opportunity now.

Step 4: Practice Placing Trades

This might sound obvious but practice the mechanics of trading on the platform before the challenge starts.

Try placing:

- Market orders

- Limit and stop-limit orders

- Bracket orders (entry, stop loss, and target together)

- OCO (One Cancels Other) orders

Risk Management in Action

Set defaults for your order sizes, stop loss distances, and targets. If you’re required to use a fixed 2% risk per trade then build that into your setup.

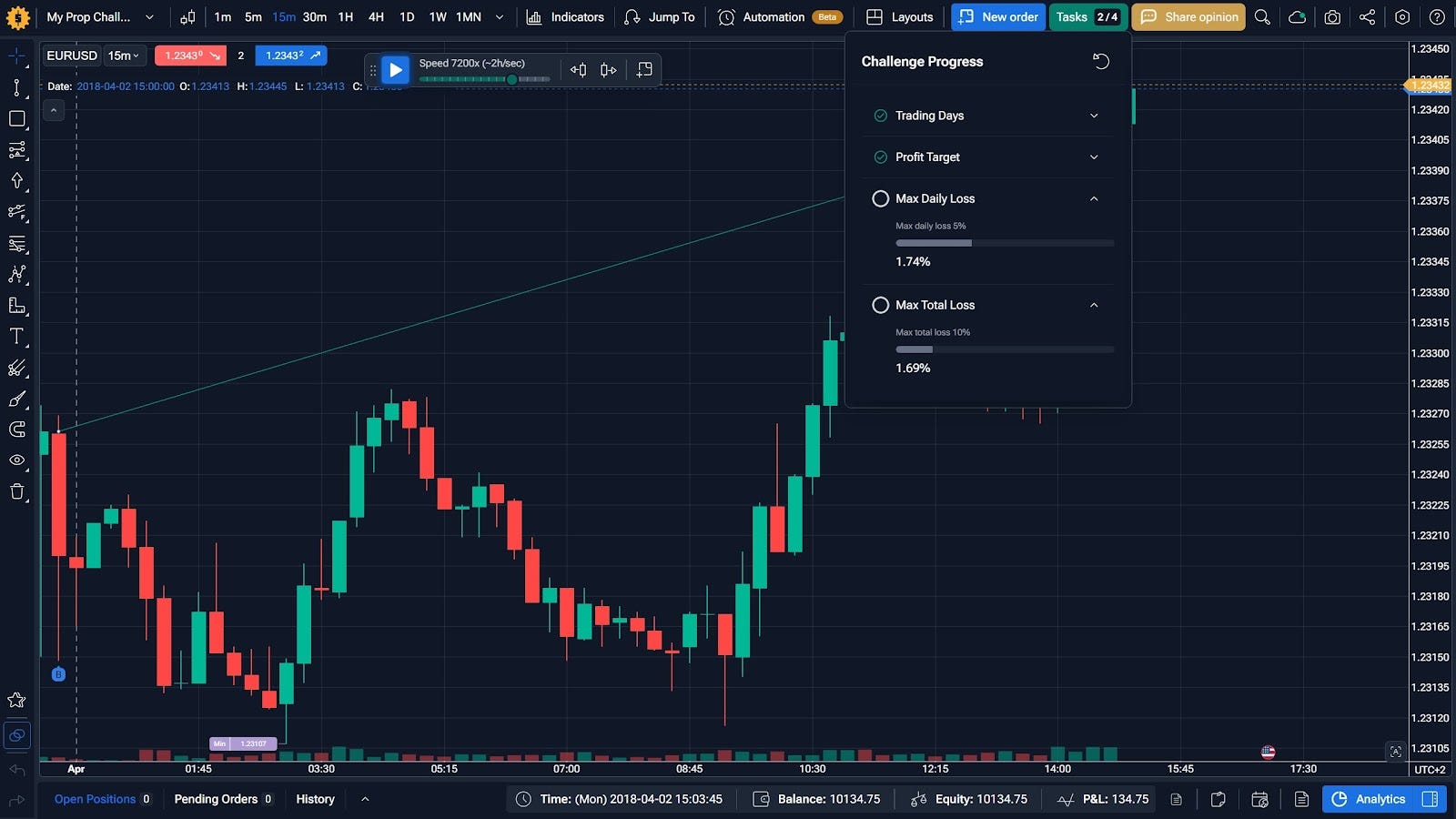

And don’t forget: most prop firms have a daily loss limit. Set alerts or auto-liquidation to prevent blowing the account in one bad streak.