In today’s hyperconnected world, convenience is key especially onlinecheck when it comes to financial transactions. With the rapid evolution of digital banking and e-commerce, the traditional methods of handling money are quickly being replaced by faster, safer, and more efficient options. One such innovation gaining popularity is the online check. Whether you’re a business owner, a freelancer, or an everyday consumer, understanding what an online check is and why you might need one could significantly simplify your financial life.

What is an Online Check?

An online check, also known as an electronic check or eCheck, is a digital version of a traditional paper check. It allows you to make payments over the internet by transferring funds directly from your bank account. The process mimics the steps of a paper check—authorizing, processing, and clearing the payment—but everything is done electronically. This makes the transaction faster, more secure, and less prone to human error.

When you issue an online check, you provide your bank account number, routing number, and authorization for the payment. The money is then electronically transferred from your account to the recipient’s, usually through the Automated Clearing House (ACH) network. The process typically takes one to three business days, but in many cases, the transfer can happen even faster depending on the platform or service used.

Why You Need Online Checks in the Digital Age

Online checks are a powerful tool for modern financial management. For individuals, they offer a secure way to pay rent, send money to friends or family, or settle bills without writing a physical check. For businesses, especially those that deal with recurring payments or pay vendors, online checks streamline cash flow and reduce the overhead costs associated with printing and mailing checks.

One major benefit is convenience. You don’t need to go to the post office or bank, or worry about whether a check was lost in the mail. Everything is handled digitally, often with the option to track and confirm when the funds are received. In a world where speed matters, online checks offer a reliable alternative to both paper checks and more expensive credit card transactions.

Enhanced Security for Peace of Mind

Many people worry about security when it comes to digital payments, but online checks are actually quite secure. The technology behind them includes encryption, fraud detection, and secure servers that protect your sensitive banking information. In many ways, they are safer than mailing a paper check, which can be stolen or tampered with en route.

Additionally, because online checks go through the ACH network, there are clear records of the transaction from start to finish. This transparency can be crucial in case of disputes or for tax documentation. Businesses benefit even more from this recordkeeping, as it simplifies accounting and auditing.

Cost Savings Compared to Other Payment Methods

If you’re a business owner, every dollar saved can make a difference. Unlike credit card payments, which often come with hefty processing fees (sometimes as high as 3%), online checks are generally much more affordable. Some banks and services offer them at very low transaction costs, or even for free, especially for recurring payments.

For individuals, eliminating the need to buy checkbooks, stamps, or envelopes can add up over time. There’s also the reduced environmental impact to consider—less paper, less ink, and fewer resources spent on physically transporting documents.

Accessibility and Flexibility

Online checks are accessible to anyone with a bank account and internet access. You don’t need special hardware, software, or a merchant account. Many banks and financial institutions now include eCheck functionality as part of their online banking platform, making it easy to send or receive payments from your computer or smartphone.

In addition, online checks offer flexibility in how you schedule payments. You can set up one-time transactions or automate recurring ones. This is particularly useful for things like rent, utilities, payroll, or subscription services. Instead of remembering to send a check every month, you can set it and forget it.

Perfect for Freelancers and Remote Work

The rise of remote work and freelance careers has created a greater demand for efficient, reliable, and global payment methods. Online checks meet this need perfectly. Freelancers can receive payments from clients without waiting for a paper check in the mail or dealing with the fees and delays associated with international wire transfers.

Platforms like QuickBooks, PayPal, and other digital wallets even integrate online check functionality, making it easier to manage invoices, receive payments, and track financial data—all in one place. This integration is not just about convenience; it’s also about professionalism. Offering multiple payment options, including eChecks, can make your freelance services more attractive to potential clients.

How to Use an Online Check

Using an online check is simpler than you might think. Most online banking systems guide you through the process step by step. You’ll usually need the recipient’s name, bank account number, and routing number. After inputting the information and verifying the amount, you authorize the payment. Once submitted, the system handles the rest.

Some services, like payment processors or accounting software, offer additional features such as digital signatures, payment tracking, and instant notifications. This not only enhances user experience but also improves transaction accuracy and speed.

Legal and Regulatory Considerations

Like all financial tools, online checks are subject to regulations designed to protect both the sender and the receiver. In the United States, for example, the Electronic Fund Transfer Act (EFTA) governs the rights and responsibilities of all parties involved in electronic payments. Banks must provide clear disclosures, and consumers are protected against unauthorized transactions under federal law.

It’s always a good idea to work with reputable financial institutions or services that comply with relevant standards and offer customer support. By choosing a trustworthy provider, you ensure your online checks are both legal and secure.

The Future of Payments is Digital

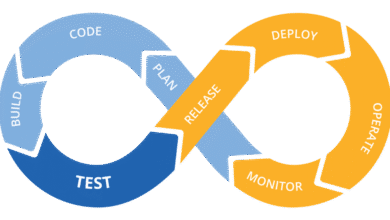

The continued shift toward digital transactions shows no signs of slowing down. As technologies like artificial intelligence, blockchain, and fintech innovation advance, the onlinecheck is likely to become an even more powerful financial tool. Whether you’re paying rent, managing payroll, or running an eCommerce business, incorporating online checks into your payment strategy offers numerous benefits—from speed and convenience to security and cost-effectiveness.

By understanding how online checks work and why they’re beneficial, you can take control of your finances in a way that aligns with the digital world we live in. It’s not just about keeping up with the times—it’s about leading the charge into a smarter, more efficient financial future.